Discover the power of the profit and loss (P&L) statement as we break down this essential financial report for your small business. Understand how to interpret your P&L to gain clear insights into profitability and make informed financial decisions.

For any small business owner, having the right tools is not just a matter of convenience; it directly impacts time, money, and energy. Among the most powerful of these tools is the profit and loss (P&L) statement.

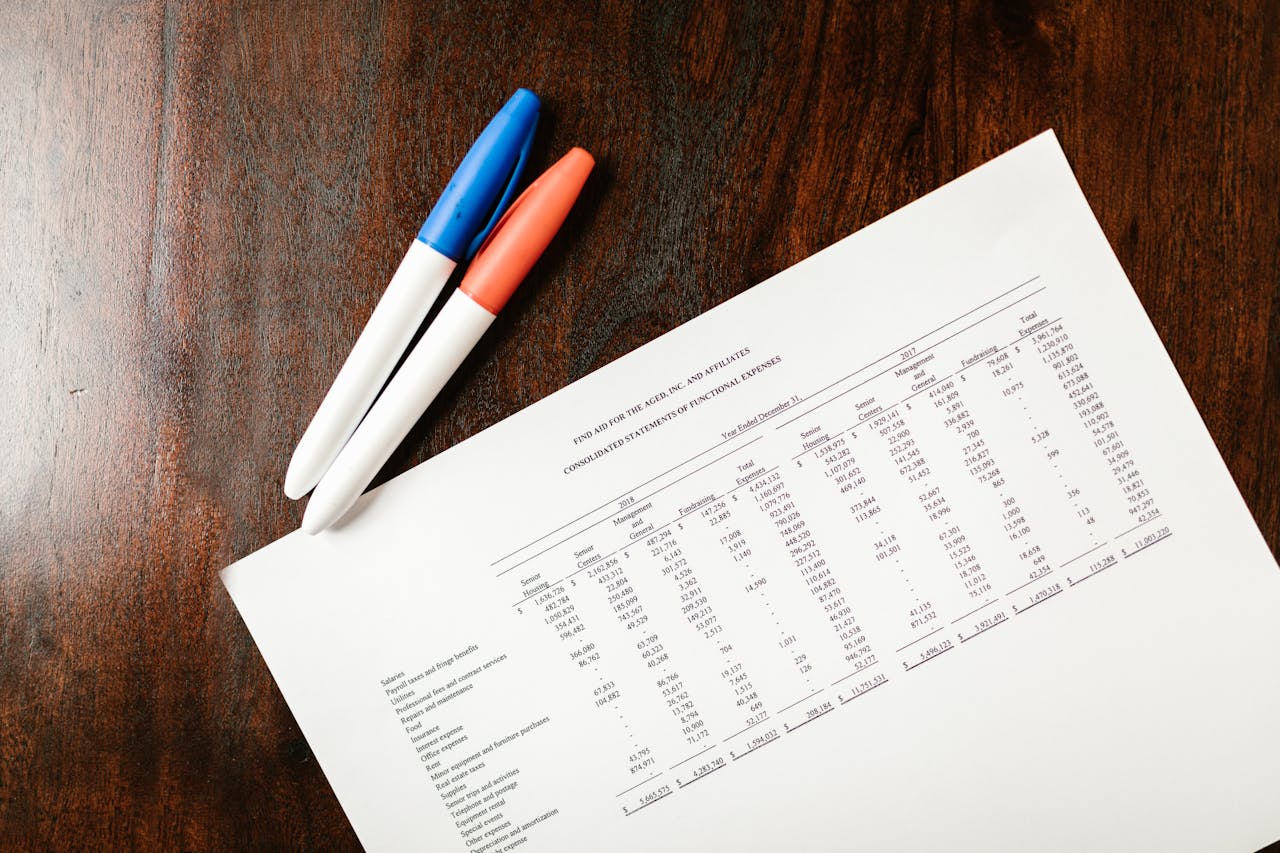

Also known as an income statement, the P&L provides a clear summary of a business's revenues and expenses over a specific period, such as a month, quarter, or year. It offers a snapshot of your financial performance, allowing you to make informed decisions, identify emerging trends, and maintain control over your operations. While the P&L statement is a critical report on its own, it is most effective when analyzed alongside two other key financial documents: the balance sheet, which details what you own and owe, and the cash flow statement, which tracks the movement of cash within the business.

Ignoring the P&L is like trying to navigate without a map—it's a risky strategy that often leads to costly missteps. Understanding this financial statement is fundamental to building a sustainable and successful business.

How does a profit and loss statement function?

A profit and loss statement is fundamentally about assessing financial vitality. It presents a clear picture of a company’s profits and expenses over a defined timeframe, showing whether the business made money or incurred a loss. However, its insights are most powerful when viewed in context.

The P&L statement is one part of a crucial trio of financial reports that all public companies are required to issue quarterly and annually. This trio includes the balance sheet, the cash flow statement, and the P&L report itself. For small businesses, while not always mandatory, producing these statements is a best practice for sound financial management.

The core of the P&L statement is a straightforward calculation that reveals the bottom line. It follows a simple formula: Profit (or Loss) = Total Income – Total Expenses.

Creating your P&L involves a few key steps:

- First, you begin with your total income, which represents all the money your business generated during the specified period.

- Next, you subtract your total expenses, which includes everything the business spent to operate, such as rent, marketing costs, and wages.

- Finally, you calculate your net profit or loss. If your income is greater than your expenses, you have a profit. If your expenses exceed your income, you have a loss.

What are the primary uses of a P&L statement?

A P&L statement is an indispensable tool that empowers you to maintain control over your company's finances and overall business health. It offers tangible insights into your performance and highlights areas that may require strategic attention, which is why keeping it current is so important.

The P&L provides a definitive answer to the ever-present question for any entrepreneur: is the business actually profitable? It doesn't just offer a simple "yes" or "no"; it provides the full context. By comparing income and expenses across different periods, such as month-over-month or year-over-year, you can effectively track growth, spot financial trends, and evaluate the success of your strategic initiatives.

Beyond revealing the narrative of your financial journey, profit and loss statements also streamline budgeting and future planning. They provide the data needed to establish realistic revenue targets, forecast upcoming expenses, and plan for significant investments like equipment purchases, new hires, or marketing campaigns.

Profit and loss statements are also invaluable during tax season. They consolidate your financial data in a structured format, simplifying the process of filing tax returns, identifying eligible deductions, and addressing any queries from your accountant. Furthermore, when communicating with potential investors, a well-prepared P&L demonstrates that you have a firm grasp of your business's performance and are serious about generating returns, which can significantly boost their confidence in your venture.

Distinguishing the P&L from other financial reports

The profit and loss statement is just one component of a comprehensive financial toolkit. While it effectively shows how much money your business has earned and spent over a period, its insights are magnified when considered alongside the balance sheet and the cash flow statement.

P&L statement vs. balance sheet

Think of your P&L statement and balance sheet as two distinct views of your business: one captures performance over time, while the other captures financial position at a single moment. The balance sheet details three key elements: everything your business owns (assets), everything it owes (liabilities), and the residual amount for the owners (equity) at a specific point in time. It's like pressing pause to see an exact snapshot of your financial standing.

In contrast, the P&L statement narrates the story of your business's performance over a set duration, whether it's a month, a quarter, or a year. Its focus is on income and expenses, ultimately showing whether you achieved a profit or sustained a loss during that period. In essence, while the balance sheet reveals what you possess, the P&L explains how you arrived at that position.

P&L statement vs. cash flow statement

While your P&L statement indicates whether your business is profitable, the cash flow statement reveals the actual movement of cash. Profitability does not always equate to having cash on hand, and this is a critical distinction for managing day-to-day operations.

For instance, a service-based business might secure a large project and record the revenue, showing a profit on the P&L statement. However, if the client hasn't paid yet, that cash is not yet available to the business. The cash flow statement provides a clear view of all cash inflows and outflows, helping you monitor liquidity and ensure you have enough funds to cover immediate obligations like payroll, bills, and other operational costs.

A line-by-line guide to understanding a P&L statement

Reading a P&L statement can seem intimidating, but it becomes much clearer once you understand its individual components. Each line tells a part of your financial story.

Revenue: This is the top line of the P&L and represents the total income generated from your primary business activities during the accounting period. It should reflect net sales, which is your gross sales minus any returns, allowances, or discounts.

Cost of Goods Sold (COGS): These are the direct expenses related to producing your goods or delivering your services. Tracking COGS helps you understand how much you spend to earn revenue. The higher this figure, the more it cuts into your profits.

Gross Profit: This figure is calculated by subtracting the Cost of Goods Sold from your total revenue (Revenue – COGS = Gross Profit). It tells you how much money you are making from your core products or services before accounting for overhead and other operating costs.

Operating Expenses: These are the indirect, day-to-day costs required to run your business. Think of them as the essential "behind-the-scenes" expenditures that keep your operations running smoothly. Examples include office rent, employee salaries, utility bills, and software subscriptions. Keeping track of these expenses can be challenging, but services like Zenceipt can simplify this by connecting to your email inbox to automatically detect and monitor invoices and receipts, ensuring no expense is missed.

Other Expenses: These are costs that fall outside of your main business operations. They are often infrequent or unexpected, such as interest paid on loans or a one-time tax adjustment. Although they can be unpredictable, they are important to track as they impact your overall profitability.

Net Income: This is your "bottom line" and represents your true profit. It is what remains after all expenses, both direct and indirect, have been deducted from your revenue. The formula is: Gross Profit – Operating Expenses + Other Income – Other Expenses = Net Income. This figure definitively tells you whether your business is making money.

How to create a profit and loss statement

If you are not using accounting software, you can prepare a P&L statement manually. This process is a great way to become intimately familiar with your business's financial data. Here is a step-by-step guide to get you started:

- Add up your revenue: Begin by calculating your total revenue for the period you are analyzing. Remember to use your net sales, which accounts for any returns, discounts, or allowances.

- Add up your COGS: Next, sum all the direct costs associated with your business operations. This can include direct labor, materials, and shipping fees.

- Calculate your gross profit: Subtract your total COGS from your revenue. The result is your gross profit.

- Add up your operating and other expenses: List and total all of your operating expenses, which are the day-to-day costs of running your business not directly tied to production. This includes rent, salaries, software, utilities, and marketing. Also, include any non-operating expenses like loan interest.

- Calculate your net profit (or loss): Finally, subtract your total expenses from your gross profit to determine your net profit.

While manually creating a P&L is insightful, especially for new businesses, spreadsheets can become cumbersome and prone to errors as your operations grow. The process can be time-consuming and may not be the most efficient use of your time.

Common pitfalls to avoid

When preparing or reviewing a P&L statement, a few common mistakes can distort your financial picture, particularly when using manual methods. One of the most significant errors is mixing personal finances with business funds, as this makes it difficult to accurately track expenses and measure true profitability.

Misclassifying expenses is another frequent pitfall. For example, incorrectly categorizing a direct cost as an operating expense can skew your gross profit and lead to flawed analysis. It is also crucial to account for tax liabilities. Overlooking them can make your profit seem larger than it actually is. Paying close attention to these details can prevent considerable confusion and extra work later on.

Profit and loss statements are essential for understanding your business’s financial health. When paired with your cash flow statement and balance sheet, you get a complete and powerful view of your financial story. By comparing P&L statements from previous periods, you can spot trends, identify potential issues, and begin to forecast with greater accuracy. This data-driven approach is your crystal ball, helping you make smarter decisions as your business evolves.

For a more visual guide on preparing your income statement and discovering the insights it holds, this video offers a detailed walkthrough.